The Decline

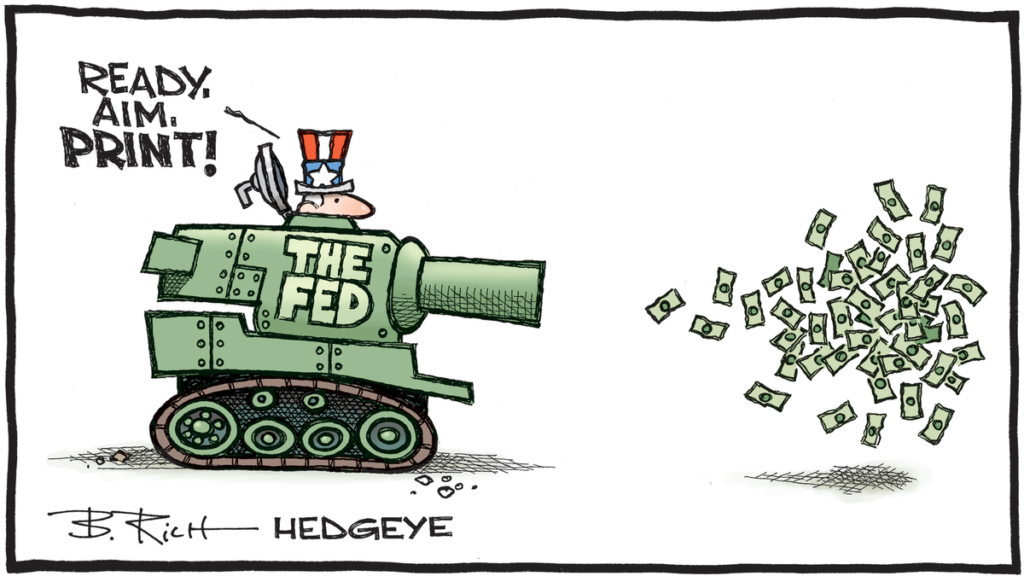

In other words, growth and inflation slowdown are imminent, and we can expect a deep Quad IV in the second quarter of 2022, whether you like it or not.

Quad 4

We are starting to see the signs of Quad IV coming down the tracks now.

Inheritance?

As much as we would appreciate a normal distribution of stock price returns, that’s just not how the stock market game works.

PVV

The three factors are Price, Volume, and Volatility with Volatility being the most important.

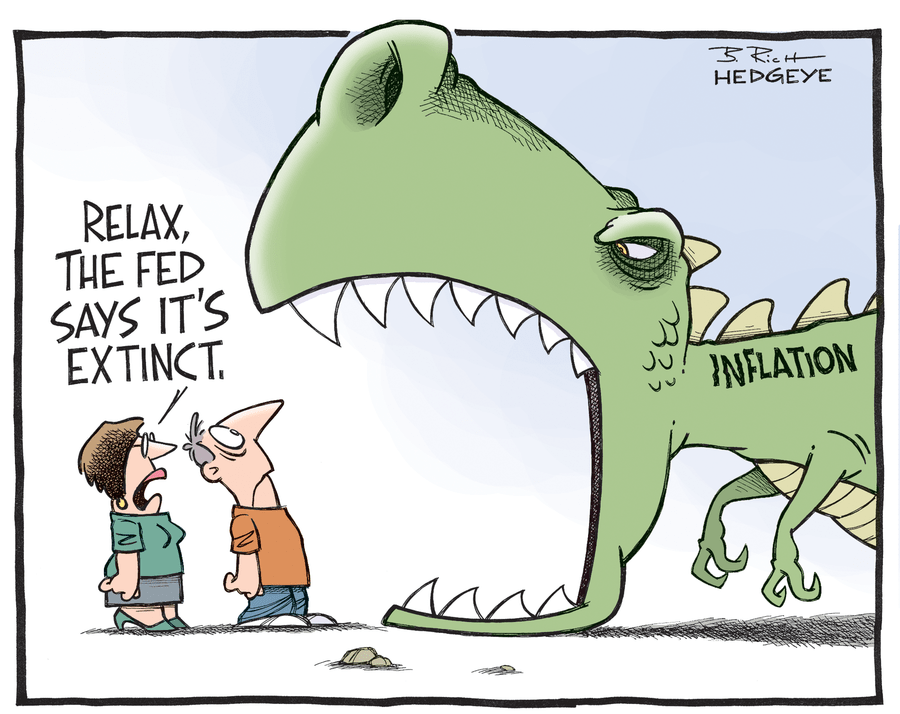

Inflation

We will soon start having some headwinds as people on unemployment and getting the extra $300 per month will soon lose the $300.

Infrastructure & College Funding

We don’t see a change in the Quads coming soon so it looks like smooth sailing for a while.

More on Housing

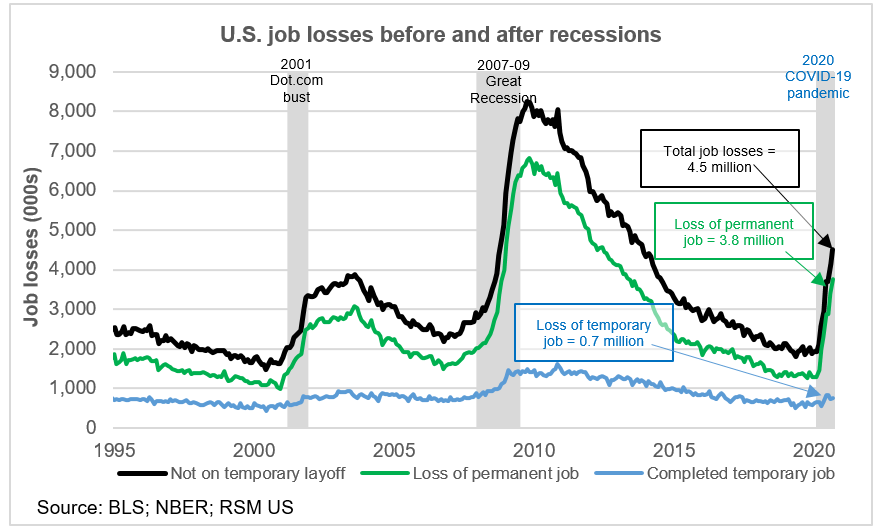

Yet, the number of initial jobless claimants remains at 16 million or roughly ten times the 1.7 million job unemployment claimants in January 2020.

Taxation of Investments

This rapid increase in housing prices may moderate going forward.

Grocery Prices Apocalypse

The inflation issue comes down to exceedingly low inventories and increased demand due to the public “getting out of jail” with lots of money in their pockets

Jobs

The US job market added only 266,000 jobs in April, falling really far short of expectations of one million new jobs.

Personal Income Rises

Starting in Mid March and through most of April, there has been a swing from growth outperformance to value outperformance.

Incapacity

What we are now seeing is a rotation from value investing back towards growth investing.

Retail Sales

We think that the March report is the start of what will be an extraordinary year in household spending.

Your Compete Number

You may want to check how you have local numbers entered into your cell phones.

Week of April 5, 2021

“When do I think things will get back to normal or the way it used to be?”

Market News and More

That means the consumer is bullish on the future.

Relief!

I find it interesting that the Nasdaq performance is up only +2.54% year to date.

Trust Basics

We see a series of lower highs and lower lows in some of the bellwether market indicators.

Pullback & Job Growth

The one negative in investors’ eyes is that all this demand will increase inflation.

The Big Drop

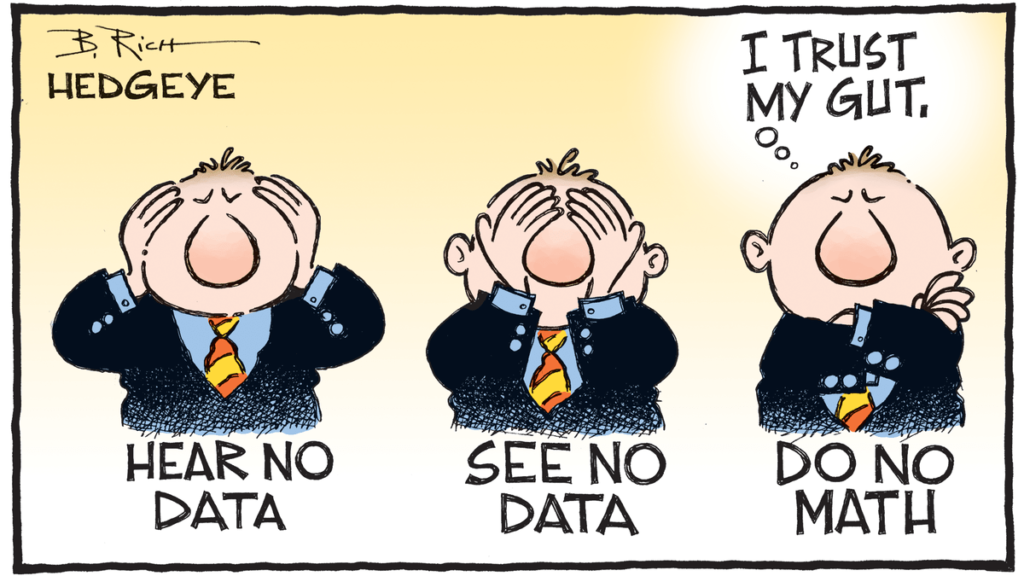

But the real question is, will the rise in interest rates adversely affect the stock market?

Nothing But Green Lights Ahead!

We expect an especially strong recovery in the economy …

Stimulus

I expect FOMO (fear of missing out) to infect most investors.

Employment

Whether this is the correct move to make probably depends on your political preference.

GameStop Explained

It’s a common but controversial way of trading in financial markets.

Markets, Marriage, & More

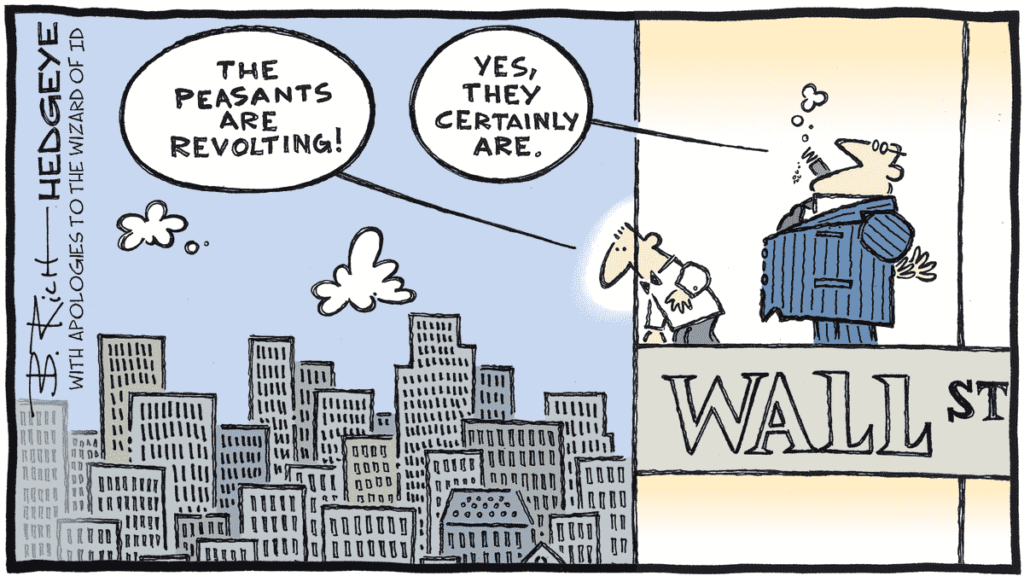

lots of money can be made in bubbles,

Repeat of Our Outlook

… a professional can evaluate your objectives and available resources and help you consider appropriate long-term financial strategies, including your withdrawal strategy.

January 11, 2021 – 1st Quarter Outlook

1st Quarter Outlook – a must read!

This is How We Do

As a new year is beginning, I thought it would be a good time to review how we manage your money.

Covid Relief Bill

We have an interesting situation in Washington developing

Relief!

We believe the positive markets will continue for the foreseeable future.

Vaccine vs Virus

… in order for the United States to reach a full economic recovery there must also be a global recovery.

Umbrella Ready?

We are solidly in Quad II globally, which is good for stock markets around the world.

Covid Analysis

Remember, in Quadrant 3, inflation increases, so if that proves accurate, interest rates will rise, bond prices will fall.

2021 IRAs

It is hard to tell which of the two forces will control the stock market over the next few months.

Vaccine

The next few weeks hopefully will give us a window into the future.

VOTE!

An intensifying pandemic and probable lack of another round of fiscal aid this year will almost certainly dampen overall economic activity to close the year and to begin 2021.

Work & Education

.. we are merely spectators until the election is over.

Stimulus and Scams

Politics aside, the country really needs a stimulus for two reasons:

Job Losses

In September, the total number of people who have lost employment — and are not on temporary layoff — reached 4.5 million.

Strange Times

Could events get any stranger?